nj bait tax refund

Use our Check Your Refund Status tool or call 1-800-323-4400 or 609-826-4400 anywhere for our automated refund system. Distributive Proceeds Originally the NJ Division of Taxation had calculated the BAIT tax base or distributive proceeds using federal rather than New Jersey taxable income.

Nj Bait And New Salt Guidance What You Need To Know Smolin

When Governor Murphy signed the Pass-Through Business Alternative.

. Beginning in January we process Individual Income Tax returns daily. Underpayment of Estimated Pass-Through Business. Looking at this in a vacuum the savings are unmistakable.

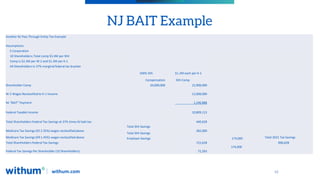

For simplicity on 5 million of distributive proceeds thats about 427888 in New Jersey BAIT tax. PTE Tax Return Form PTE-100 reference copy Instructions. 15 2022 the New Jersey Division of Taxation announced an extension of certain due dates related to the New Jersey Pass-Through Business Alternative.

PTE Revocation of Election and Claim for Refund. Transferring information from returns to New. Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members.

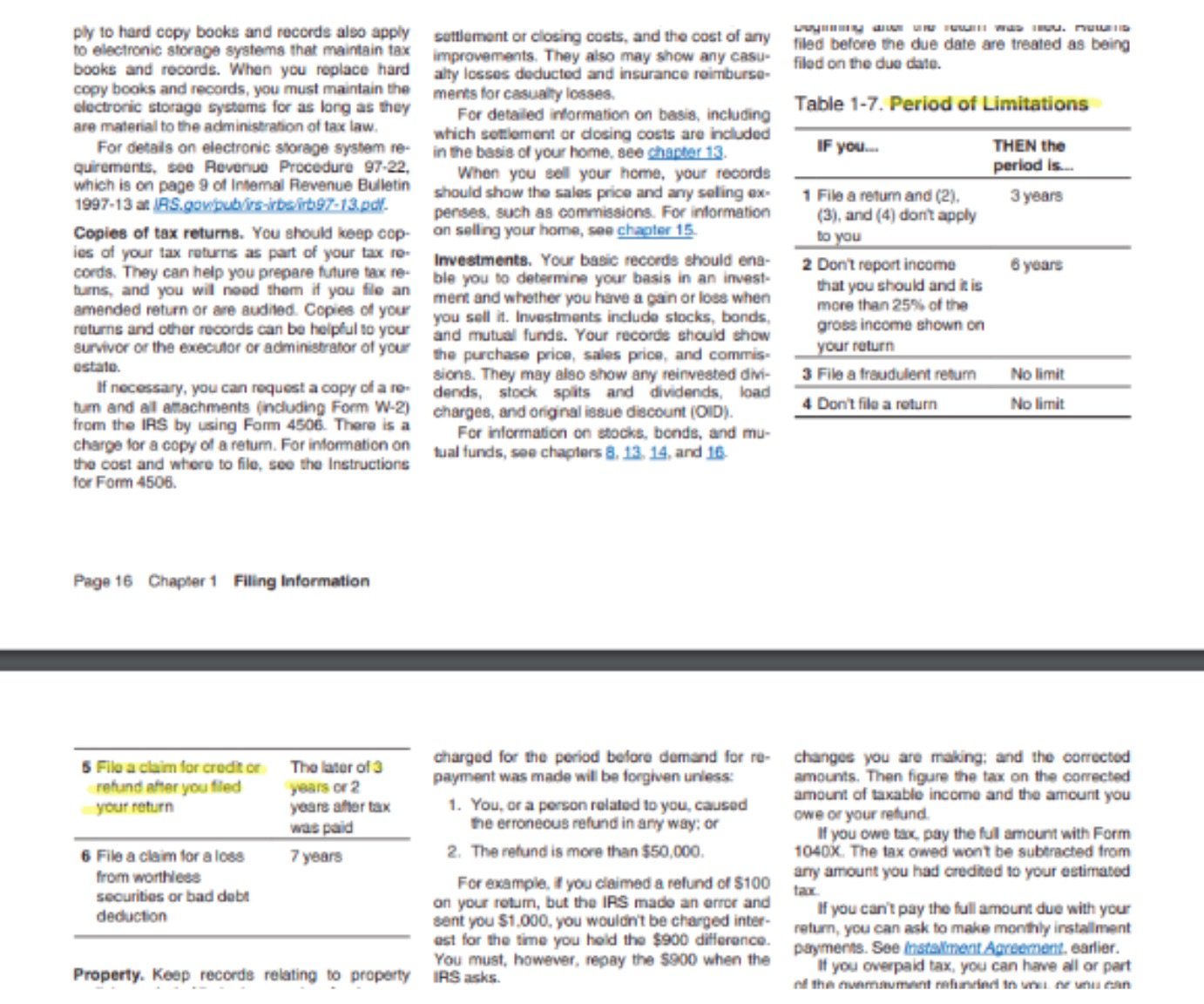

Excess credits may be carried forward for twenty. Late in the day on Mar. How New Jersey Processes Income Tax Refunds.

New Jersey State Tax Refund Status Information. PTE Revocation of Election and Claim for Refund. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns.

Assume a PTE filed its 2021 BAIT return on. There is no limit on the deduction of state taxes. In addition for Tax Year 2021 an S corporation has the option to use a three-factor allocation formula on NJ-NR-A for purposes of the BAIT.

PTE Tax Return Form PTE-100 reference copy Instructions. It is used to offset the tax on the individual return. 24000 400K x 6 The NJ BAIT tax deducted at entity level would be added back to taxable earnings for the calculation of NJ income tax.

Refunds of BAIT payments at the PTE owner level could be subject to federal income tax in the year in which the refund is received. This change does not affect TY 2020. For tax year 2022 a partnership can continue to claim credit for the amount of tax paid on its Form NJ-CBT-1065 or it can choose to allocate its share of the Pass-Through Business.

NJ Business Alternative Income Tax BAIT By Michael Brown CPA. Underpayment of Estimated Pass-Through Business. Tax Prager Metis Jan 28 2022.

The credit may not reduce the tax liability below the statutory minimum tax. Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and.

The owners may then claim a refundable tax credit for the amount of tax paid by the pass-through entity on their share of distributive proceeds. Taxpayers who earn income from pass-through businesses and pay the BAIT can obtain a refundable gross income tax credit. Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members.

While this legislation could provide.

Nj Division Of Taxation Check The Status Of Your New Jersey Income Tax Refund

New Jersey State Tax Updates Withum

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

Refund Status James Biggin Cpa Llc 516 752 0017

N J Residents Due More Than 35m In 2017 Tax Refunds Irs Says Nj Com

5 Ways To Spend Your Income Tax Refund Military Com

New Jersey Pass Through Business Alternative Income Tax Act Bait L H Frishkoff Company

Prepare Your Taxes Online E File For Biggest Guaranteed Refund

State Of Nj Department Of The Treasury Division Of Taxation

Nj Bait Developments News Levine Jacobs Co

State Of Nj Department Of The Treasury Division Of Taxation

Bamboozled Turbotax Error May Be A Problem If You Filed This Type Of Return Nj Com

Withum Healthcare Tax Update 2022

How To Get A Tax Refund Years Later Wealth Factory

Nj Division Of Taxation Check The Status Of Your New Jersey Income Tax Refund

East River Federal Credit Union Watch Out For Tax Refund Scams

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis